Before the Covid-19 pandemic, most countries were heavily affected. E-commerce and F&B industries flourished, but alongside, many industries struggled due to oversupply and stockpiled goods, including the packaging and paper industries. The following article provides objective insights for paper industry businesses to assess the impact and find appropriate solutions.

Demand for paper packaging may surge post-pandemic

Geographically, most major paper mills in China are located 600 to 1,000 km away from Wuhan, so they are likely to be allowed to resume production soon after the outbreak is controlled.

However, since Wuhan is centrally located and considered the "industrial lung" of China, if the epidemic situation does not improve within the next 7-14 days, the likelihood of paper mills continuing to remain closed is high. The Chinese paper industry may face the following challenges:

Delayed or indefinite postponement of workers returning to factories;

Paper businesses facing significant challenges in disease prevention and security control;

Upon resumption of work, there may be shortages of raw paper materials, supplies, spare parts, as well as limitations in capacity and efficiency of logistics services;

Post-pandemic demand for paper packaging may surge, and prices will increase due to raw material shortages;

Demand for various paper-based products such as food packaging boxes, tissue paper, and specialty papers may increase, while demand for office paper may decrease;

Not only China may face these challenges, but many other countries also need to find solutions to these issues as China currently plays a crucial role in the global paper industry.

Paper price hikes affecting paper packaging product prices

For the paper industry, the impacts on supply and demand are not yet significant, but due to the epidemic, China's supply has decreased, leading to increased demand in other markets. Expanding production at this time is not feasible. Combined with consumer psychological unease, prices are forecasted to increase in the short term, as some suppliers have already announced price hikes in February 2020.

Specifically: Duplex paper mills in South Korea have announced price increases of USD20-30/ton; Indian Duplex paper mills have announced a USD30/ton price increase at the beginning of February. South Korean Couche paper suppliers have also indicated an expected USD20/ton price increase.

This price increase is not solely due to the Covid-19 epidemic but partly because Indian paper mill prices have remained stable for a long time. Additionally, paper raw material prices, including recycled paper, have increased by USD10-20/ton since January 2020, providing a suitable time for manufacturers to adjust selling prices.

Significant impact on Vietnam's packaging industry

In 2019, Vietnam exported paper (mostly corrugated and plain paper for packaging) to China, nearly 540,000 tons, accounting for 67% of total paper exports. Therefore, as exports to China decrease sharply, Vietnamese companies need appropriate solutions to avoid production and inventory impacts.

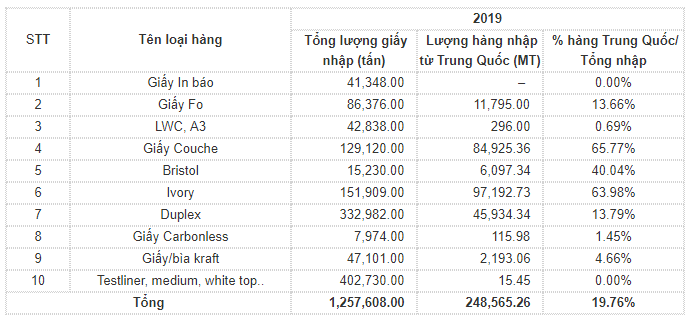

Import information of Vietnam's paper in 2019 according to Customs:

Import information of Vietnam's paper in 2019

According to VPPA, due to the epidemic's impact, Vietnam's trade with China is facing some difficulties:

The authorities of northern border provinces are tightening control at border gates, with Lang Son temporarily suspending customs clearance at many border gates.

Freight vehicles from China entering Vietnam from Chinese ports must undergo inspection and quarantine according to regulations within 14 days, resulting in additional costs and delayed schedules, leading to slow and inadequate supply.

Exported goods to China from Vietnam are congested at border gates due to no recipients, delivery, and reduced demand, among other reasons.

In addition, Chinese laborers will have to extend their holidays and are not allowed to enter Vietnam, leading to potential shortages of experts and technical labor, halting production, etc.

Therefore, the impact of the Covid-19 epidemic on the import and export of the paper industry is significant and may prolong, affecting related industries such as paper packaging production, printing, packaging, and products using paper and packaging.

Coping solutions for the paper packaging industry

According to experts, paper industry businesses need to calmly monitor the epidemic situation for adaptation and timely preparation. They must quickly devise solutions to cope with the current difficulties as the epidemic is forecasted to continue.

Specifically, companies in the industry need to proactively seek and diversify sources of supply for materials, equipment (mills, drying mats, spare parts, etc.), experts, and paper products such as Couche, Bristol, Ivory, Duplex, etc., from other markets such as South Korea, Japan, India, Southeast Asia, and European countries to ensure uninterrupted production and avoid dependence and passivity in the future. At the same time, they need to accurately assess the export demand for paper packaging and goods (mainly agricultural and seafood) to China to ensure liquidity safety and avoid high inventories.

Source: VPPA

------------------------------------------------------------------------------------------

GREEN PACKAGING JOINT STOCK COMPANY

- Head office: Lot 99, My Tho Industrial Park, Trung An Commune, My Tho City, Tien Giang Province.

- Tay Ninh Branch: 285 Tran Phu, Ninh Thanh Quarter, Ninh Son Ward, City. Tay Ninh, Tay Ninh.

- Representative office: 374 - 374B Vo Van Tan, Ward 5, District 3, City. HCM.

- 0961 416 688 - (0267) 3822 426

- Email: info@greenpackaging.vn